Pacific Business Valuation’s professionals have collectively valued hundreds of privately-held businesses and business ownership interests. With that experience, they possess the knowledge and expertise to provide valuation services for a variety of purposes.

Reasons for Valuation

- Business transition planning

- Gift and estate tax appraisals

- Buy/sell agreements

- Strategic planning

- Mediation and litigation

- Partner/shareholder disputes

- Divorce

- Employee Stock Ownership Plans (ESOPs)

- Merger & acquistion

- Due diligence

- Financing

Sample Engagements

Business Transition Planning – Valued family construction businesses for exit planning purposes to assist with the transfer of ownership from father to son.

Divorce – Valued dental offices for divorce purposes; Testified in family court regarding opinion of value; Assisted with the preparation of written closing arguments.

Gift & Estate Tax Appraisals – Valued real estate and investment holding entities for gift and estate tax purposes; Determined discounts for lack of control and lack of marketability using widely accepted methods, studies and databases.

Merger & Acquisition – Estimated value of various physician practices to assist with due diligence process.

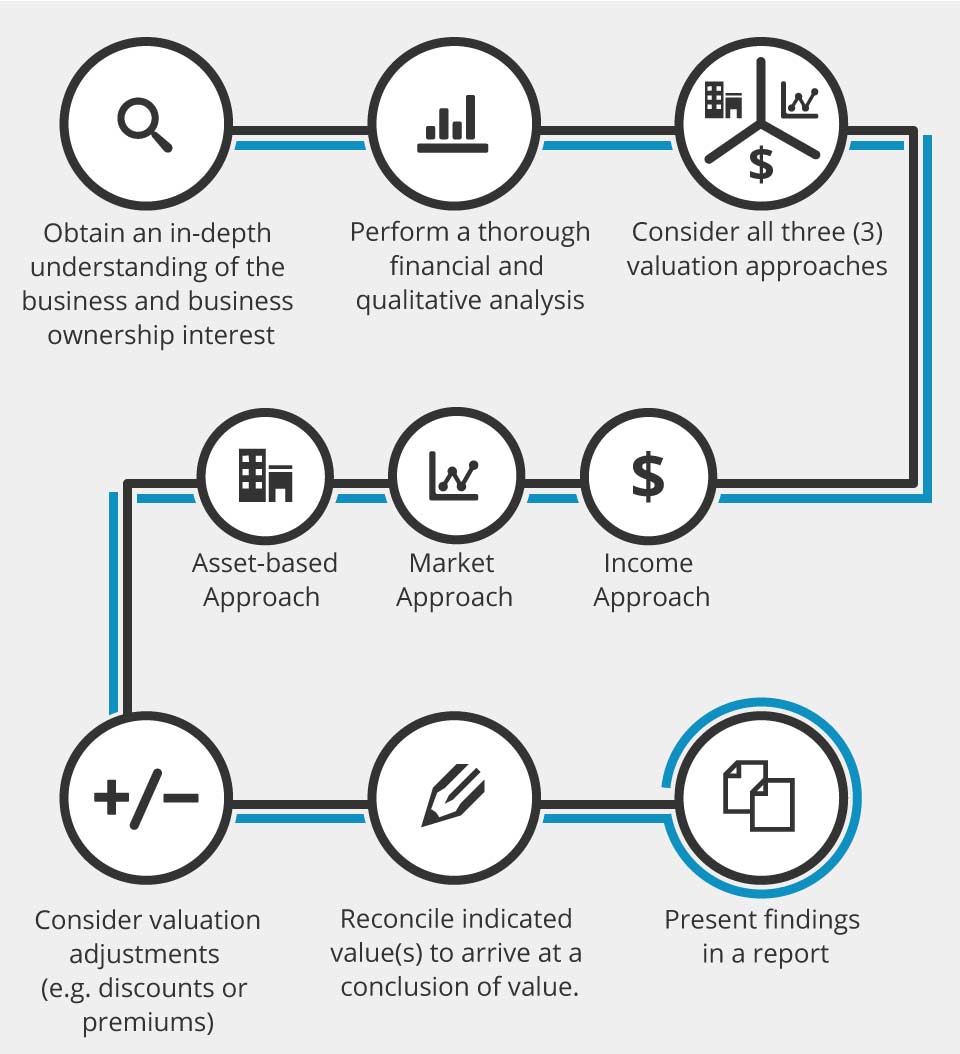

The Valuation Process