In conversations with business owner clients, particularly those who are planning for a transition of their business, the topic of “goodwill” is regularly discussed. Often, the conversation intensifies when clients receive our valuation report and learn that the value of their business is not as high as they were hoping. They might ask: Where is the goodwill value of my business reflected in your report? Or – How can my company only be worth $X when I have been in business for over 30 years?

This article will summarize the elements of goodwill, explain the difference between personal and enterprise goodwill, and discuss the significance of transferable vs. non-transferable goodwill as it relates to ownership transition planning.

Goodwill is defined by the International Glossary of Business Valuation Terms as “that intangible asset arising as a result of name, reputation, customer loyalty, location, products, and similar factors not separately identified.” Other elements of goodwill can include technical expertise, brand recognition, and intellectual property.

The elements of goodwill have been refined for practical purposes. Business valuation professionals, courts, and the Internal Revenue Service recognize that two general types of goodwill exist: (1) personal goodwill, also known as professional goodwill, and (2) enterprise, or practice goodwill.

Personal goodwill includes the skills, knowledge, wisdom, experience, relationships, reputation, and personal abilities of individuals within a business. As mentioned in a previous post, personal goodwill is to be excluded from the value of a business for divorce purposes in Hawaii and many other states. For federal income tax purposes, personal goodwill is exempt from taxation at the corporate level when a C corporation’s assets are sold, thus avoiding the issue of being taxed at both the corporate and individual levels.

Enterprise goodwill consists of the characteristics connected to a business that provide an economic benefit regardless of individual ownership. These characteristics could include company reputation, location, products, and brand recognition.

Enterprise goodwill is, by definition, transferable – it stays with the business regardless of ownership. The transferability of personal goodwill is not as certain.

Generally, personal goodwill is considered to be non-transferable because it attaches to an individual. This is true with respect to the elements of experience, wisdom, reputation, and abilities. However, some elements of personal goodwill are transferable, such as customer and supplier relationships, knowledge of operating procedures, and technical expertise. In such cases, personal goodwill can effectively become enterprise goodwill.

The transferability of certain elements of personal goodwill is significant for at least two reasons, and both reasons address the hypothetical questions posed above regarding the impact of goodwill on business/ownership transition planning. (Where is the goodwill value of of my business reflected in your report? And – How can my company only be worth $X when I have been in business for over 30 years?)

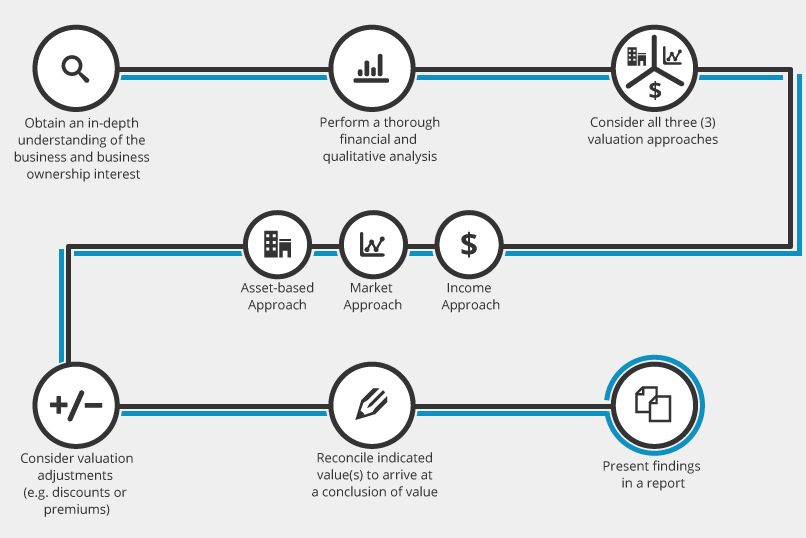

Reason 1 – In a fair market value appraisal, only transferable assets are reflected in the conclusion of value. As described in a previous post, an underlying premise in the definition of fair market value is that it considers only property that can change hands. Therefore, when we are engaged to estimate the fair market value of a business or business ownership interest for transition planning purposes, the conclusion of value in our report would include the value of all transferable goodwill, if any.

Reason 2 – For business owners planning a transition, the exchange of transferable personal goodwill can take several years, especially in cases involving professional practices. Since a business is worth the present value of its future benefits, the more cash flow a prospective buyer can expect a business to generate regardless of individual contribution, the more valuable a business becomes. In order to realize maximum value for a business, owners should be prepared to facilitate the transfer of as much knowledge, expertise, and relationships as possible. This can be done by preparing internal operating manuals, working with a prospective buyer for an adequate period of time, and through earn-out arrangements where a portion of sale proceeds is contingent upon future events.

We hope that you found this article to be informative and helpful. We regularly assist business owners and advisers with the transition planning process. Please feel free to contact us if you would like to discuss your situation.